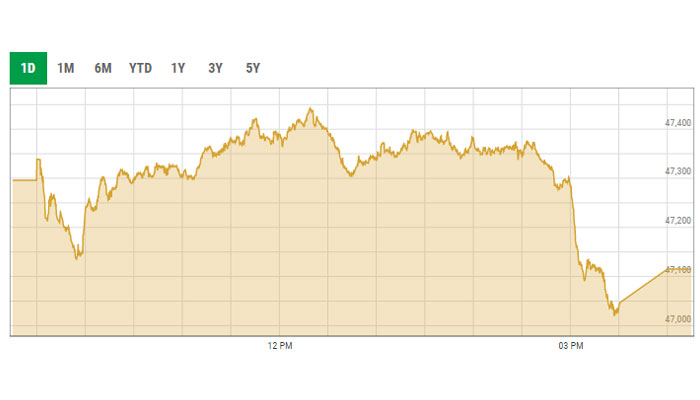

KARACHI: The bears staged a comeback at the Pakistan Stock Exchange (PSX) on Wednesday for the reason that benchmark KSE-100 shed over 180 problems amid sure triggers and an not sure monetary and political outlook.

The KSE-100 index endured a range-bound session, which ended on a bearish follow. Selling power was once as soon as well-known inside the era, banking and oil sectors.

Moreover, rupee depreciation against the us dollar coupled with uncertainty regarding the World Monetary Fund (IMF) programme dented investors’ sentiment.

Expectations of a gas worth hike coupled with higher international oil prices stored inflationary problems intact and market certain facets in check out throughout the session.

At close, the benchmark KSE-100 index recorded a decrease of 180.76 problems, or 0.38%, to settle at 47,115.04 problems.

A record from Arif Habib Limited well-known that {the marketplace} persevered to stick range-bound today as inflationary problems heated up among investors after the commentary were given right here from Adviser to the Prime Minister on Finance Shaukat Tarin that IMF has asked the government to further hike the levy on petroleum products.

“Textile sector remained underneath power as Ministry of Energy (Petroleum Division) had already moved a summary to the federal cabinet for completing subsidised gas supply to the commercial sector along side captive power crops right away,” it discussed.

The record added that the duty persevered to stick side-ways for the reason that market witnessed hefty volumes inside the third tier stocks.

On the flip-side, institutional process stayed lacklustre. Throughout the final purchasing and promoting hour, profit-taking was once as soon as witnessed across the board mainly led in the course of the era sector.

Sectors contributing to the potency include era (-45 problems), exploration and production (-28 problems), banks (-26 problems), pharmaceutical (-20 problems) and engineering (-19 problems).

All through the session, shares of 368 listed companies have been traded. At the end of the session, 125 stocks closed inside the green, 228 inside the red, and 15 remained unchanged.

Basic purchasing and promoting volumes surged to 364.9 million shares in comparison with Friday’s tally of 469.9 million. The price of shares traded throughout the day was once as soon as Rs12.8 billion.

Hum Neighborhood Limited was once as soon as the amount leader with 39.6 million shares, gaining Rs0.23 to close at Rs39.6. It was once as soon as followed thru Telecard Limited with 30.1 million shares, gaining Rs0.39 to close at Rs19.02, and First National Equities with 26 million shares, shedding Rs0.31 to close at Rs10.04.